by Brian de Lore

Published 20th June 2020

Here is racing’s biggest ever certainty: That TAB NZ is not a sustainable business for the long-term benefit of New Zealand racing and finding an overseas betting operator with which it can enter into a partnering arrangement is an inevitability more for the immediate future than the long-term.

Events of the past three months have underlined the urgent need for New Zealand racing to think globally rather than nationalistically about how it can manage this business sustainably as it enters the third decade of the 21st Century. Narrow-minded detractors have resisted the basic concept of entering into a mutually beneficial arrangement with the belief they are giving something away for nothing.

COVID-19 hasn’t held racing back as much as this ‘old boys neurosis’ about partnering the TAB, which might be a better description than the word ‘outsourcing’ as stated in the Messara Review. The difference is only subtle; semantics, as one is obtaining services from an outside supplier while the latter might be defined better as a strategic relationship to achieve a sustainable, competitive advantage. In both cases Kiwis retain full ownership of the TAB.

Resistance to partnering comes from people scared of the dark; the anti-entrepreneurial who imagines the bogeyman is hiding under the bed when they switch the light out at night. How can anyone be against a partnering arrangement before negotiations even commence? – but the flat-earthers are definitely out there alive and well.

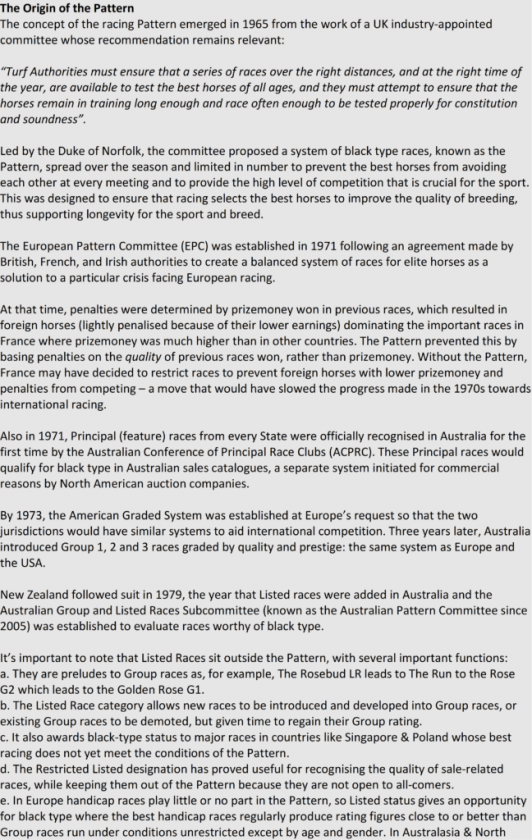

…the gambling world has consolidated with mergers…

In a short space of time, the gambling world has consolidated with mergers and takeovers rife in 2019 and this year. Scale is everything and the May completion of the merger of Flutter and the Stars Group to form a Dublin based company with a market cap of £10 billion is proof enough.

The Stars Group released this statement on April 30, 2020: “With the overwhelming approval of our shareholders last week and receipt of all remaining regulatory approvals, we look forward to completing our combination with Flutter next week. We are very excited about the potential of this combination, which will create a global leader in online betting and gaming with a portfolio of trusted brands, complementary best-in-class products, diversified revenues, stand-out technology and, most importantly, outstanding teams of exceptional people around the world.”

The point is, such mergers are based on the pooling of resources and synergies to save the group hundreds of millions of dollars, particularly in the areas of IT development and marketing. Recognition of the advantages comes with shareholder approval who only ever vote with their pockets.

Australian based betting operators, including Tabcorp, are still showing an interest in a partnering (partnering, not a merger) arrangement with our TAB. I say still because in the two years since John Messara in his review strongly advised the New Zealand industry to start negotiating, betting revenue in New Zealand has been stalled or declining, and the deal in 2020 might not be as good as the one that was possible in 2018. Nevertheless, partnering is better a better option than seeing a further reduction in prizemoney distributions and the inevitable depletion of racehorse ownership and defections to Australia.

Even the smaller Australian corporate bookmakers will struggle to survive long-term and trends world-wide suggest more mergers or thinning by natural attrition. Long-term, New Zealand wagering can neither afford to market itself against the corporates or go it alone.

Marketing costs are increasing faster than betting revenue

Marketing costs are increasing faster than betting revenue, making smaller operators less competitive – between all Australian betting operators the spend annually has risen from very little to in excess of $300 million. The movement away from the tote to fixed-odds has also reduced margins.

The advantages of partnering go something like this: Instead of TAB NZ funding its own FOB platform with commitments for ongoing payments for the next 10 years – total cost in the vicinity of $200 million, they do what RWWA in Western Australia did and pay a flat fee of $7 million annually to plug into Tabcorp’s FOB and benefit from their ongoing IT developments.

Or, New Zealand negotiates a larger package and includes all of its betting services and 100 percent comingling of the pools, and achieves massive cost savings on salaries and wages, IT development, turnover related expenses, advertising and promotions, comingling, rent, repairs and maintenance, accountancy, consultancy, travel and accommodation and a $14 million cost shown as other expenses.

Three years ago, Deloitte prepared a report to assess the potential from a partnering arrangement and concluded $70 million in cost-saving synergies were available. But cost saving is only one-half of the potential benefits of partnering because a good agreement will provide an avenue for saving future capital investment and opening up several new revenue streams.

Using the most advanced technology by plugging into Australia might bring back a sizeable proportion of the 35 percent loss in the TAB customer base. The service from the TAB would go from woeful to wonderful. The failure of the FOB and its dodgy website may see it written off and red carded into history, and yields would likely improve with a competitive FOB coupled with better risk management and hedging processes. As well, customers would have available a full range of betting options that our TAB only dreamed of introducing but could never afford.

…potential for a much-improved phone app and website

Plugging into Tabcorp’s or a Sportsbet computer also has the potential for a much-improved phone app and website. The TAB website was launched only 18 months ago with the FOB, but from day one it has never been satisfactory and is not fixable, or the funds aren’t available to fix it – the latter the more likely of the two as not all the Openbet updates have been done due to lack of money.

Below budget turnover and the onset of COVID-19 has surely dampened-down the negotiating limits on a partnering deal, but such an arrangement could also include a worthwhile upfront fee and an agreement that provides a guaranteed level of income annually and a profit share of the additional profit generated by the partnership over and above the benchmark.

A sophisticated betting partner will also utilise the value of New Zealand’s unique global time-slot – an opportunity that won’t materialise under the present regime. That would mean a consolidation of New Zealand venues to produce better racing surfaces and aesthetically improved visuals of New Zealand racing on which the Asian market can bet at 9.00 AM in Hong Kong. The potential for New Zealand racing to develop that Asian market is massive.

The business of betting in New Zealand would be better served under the control of a good commercial operator and run separately to the organisation associated with running racing – the Australian system proves it works. New Zealand is infested with government control which is still visible on every page of the wording put forward for the second reading of the Racing Bill.

In a letter written to Minister Peters recently, I asked five questions of which he answered two. One of the Minister’s answers said: “The Government does not accept the success of all recommendations rests solely on the recommendation of seven (meaning Recommendation 7 of 17 in the Messara Review). Having said that, the Bill will allow the industry greater commercial freedom to explore options such as outsourcing and partnerships.”

The opposition to partnering is gradually disintegrating. The IP (Intellectual Property) is coming back to the codes, and the landscape is changing, and the passing of the Racing Bill will hopefully lead the industry closer to a TAB run commercially and profitably for the stakeholders of racing and a brighter future.

The post Partnering the TAB is the best way forward appeared first on .