by Brian de Lore

Published 17 April 2020

We have no racing; we have no idea when Jacinda & friends will permit the resumption of racing; the TAB is likely to be in breach of the law for trading while insolvent; racing falls further into debt as each week passes.

The 135 employees quoted in this headline is really 136 but because Executive Chair Dean McKenzie who took over from John Allen on January 1st is on an unknown remuneration, he is left out of the calculation. They are not my figures but come from a reputable accountant equally concerned about the current state of racing and its apparent inability to adjust to the moving floor beneath it.

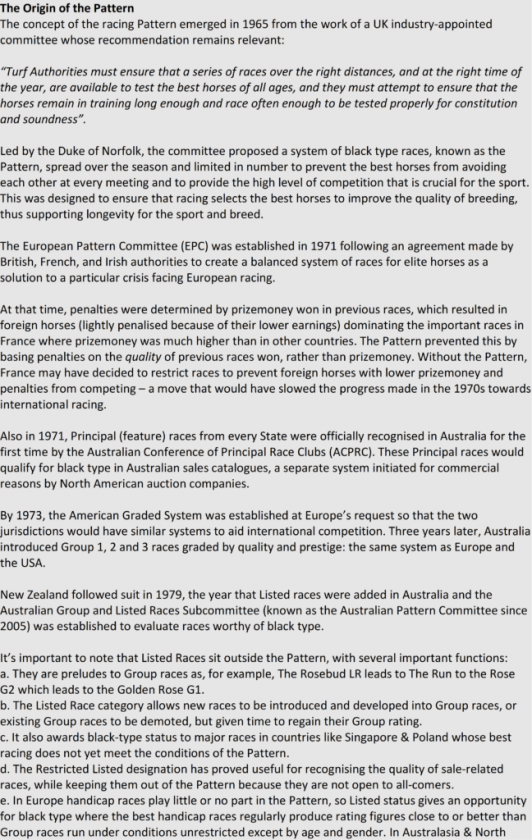

| Salary Range | Employees | Cost per annum | Average cost |

| NZ$100k-$150k | 98 | 11,690,000 | 122,000 |

| NZ$150k-$200k | 28 | 4,870,000 | 174,000 |

| NZ$210k-$390k | 11 | 3,265,000 | 297,000 |

| Total | 135 | $19,825,000 |

The cost of the infamous gravy-train. If 50% of the cost of these employees were gone tonight it would save the stakeholders of racing enough money to run an extra Saturday weekly eight-race card at $24,000/race.

A second, reputable and long-standing accountant in the industry, John Aubrey, has made an assessment of the fiscal state of the industry from last year’s Annual Report which is reproduced below. He also emphasises that the 2019 figures now have some age while expressing concern that the half-year result to January 31st has not yet surfaced despite the fact that we are now in the second half of April.

You don’t have to be Einstein to understand that New Zealand racing right now is flyblown (as the Aussies would say), destitute, insolvent, impecunious, penniless, impoverished, broke or on the rocks. Everyone knows it, but whatever adjectival description you prefer, no one wants to say it.

Let’s maintain the stiff-upper-lip they would say, as Kiwis with English and Scottish ancestors would have done; maintain your dignity, never say die and carry on to the bitter end. For NZ racing, however, the bitter end might be avoidable if we could only extract the truth and recognise those in charge are clueless.

RITA is awaiting the outcome of an application for a Government bail-out, citing the COVID-19 as the issue, no doubt. Will the people at Treasury with the Minister of Racing pushing the issue buy into it and give racing an estimated $80 million hand-out/loan?

If it was a level playing field the answer would probably be, no! But in New Zealand politics nothing much is on the level, I would suggest, and the forthcoming answer isn’t one to bet on without inside knowledge.

NOTES ON RITA FINANCIALS by John Aubrey

WHAT IS THE BOARD’S FINANCIAL POSITION?

NOTE: The figures below have been taken from the 31 July 2019 Financial Statements. The statements for the half year to 31 January 2020 are not yet available.

- The financial statements of the NZ Racing Board (now called Racing Industry Transition Agency, or RITA ) do not show a strong position. As at 31 July 2019, the reported net profit before distributions was $136 million, down on 2018 by $9 million. Distributions to the Clubs and Gaming totalled just on $162 million.(2018, $159 million)

- The equity or capital (assets less liabilities) of RITA has at 31 July 2019 dropped to a disturbing $24.8 million. In 2016 the comparable figure was $74 million. Go back to 2011 and the equity was $81 million.

- Where have the funds gone ? The accounts disclose that some $105 million was spent on computer software. Presumably, most of this is on the fixed odds betting platform. This author’s calculation differs from that set out in the notes to the financial statements. Of the total cost, $65 million has been amortised to date leaving a book value at 31 July 2019 of $40 million.

- In addition to expenditure on betting software RITA was propping up the codes/clubs by payments exceeding the available profit. In 2019 the payments to the codes and sports bodies exceeded the net profit by $28 million and in 2018 by $16 million.

- The question that must now be asked is simply “is a second-hand betting software worth the $40 million?” Note 19 to the financial statements states that the software has an estimated useful life of 3-7 years and the amortisation is charged annually on a straight-line basis. Note 19 also states that “Intangible assets are tested for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable.” Given the current liquidity issues and the COVID 19 outbreak would the auditors insist on an increased amortisation sum? If the amortisation was for some reason to be “speeded up” the equity of RITA would be getting close to zero, or worse.

- On a straight assets less debts calculation, the TAB, or RITA, is worth nothing, However, the real asset is the monopoly right to conduct betting in New Zealand. This comes in two forms. Firstly, the sole or exclusive right for this country. Secondly, the ability to conduct betting over a number of years. In Australia this latter sum is huge, but most of the funds paid have gone to Government for payment of a gaming licensing fee for 20 or 30 years. The value of this intangible asset can be realised only by an outsourcing arrangement or an outright sale of the TAB to another operator.

- The notes to the 2019 RITA financial statements say only that the broadcasting licences are carried at cost less accumulated amortisation and impairment losses. There is no mention of the term of the licences but the original costs amounted to $2.9 million. The current book value, cost less depreciation or amortisation, is just over $1 million.

- The RITA has an unsecured revolving credit facility totalling $45 million. $10 million was drawn in the 2018 year and $25 million in 2019, leaving $10 million undrawn. Rumour in the industry has it that this has been drawn down subsequent to balance date.

- Disturbingly, the 2019 Statement of Financial Position discloses Current Assets of $49 million but Current Liabilities amount to $71 million.

- Quick Assets ratio. This is the ratio of liquid current assets ($18.1 million) to all current liabilities ($47.8 million). As at balance date 31 July 2019 the ratio is .38. This is very poor. The betting account deposit and vouchers, ($23.4 million) balanced by the trust term deposit of $25 million have been removed from this calculation.

- The RITA update of 2 April 2020, following the COVID 19 shutdown, makes distressing reading. RITA advise that the product available for betting is down about 75%. The telling comment is on page 2 – “…when we can’t sell any bets we can’t make any money and in fact with the fixed costs of the business (rent, insurance etc) continuing we are losing money.“ Not making a profit means no funds for the clubs.

- RITA obviously have grave financial issues. If betting cannot be restored to reasonable levels in the next couple of months RITA must surely be close to insolvency. One definition of insolvency is “unable to pay debts as they fall due in the normal course of business” and another, “having liabilities in excess of a reasonable market value of assets held”.