by Brian de Lore

Published 8 November 2019

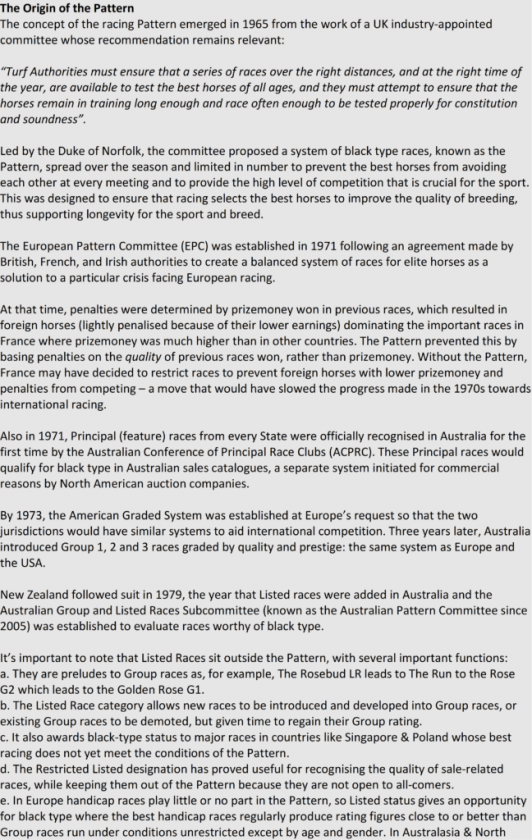

The headwinds for racing which were thought to

be zephyr-like at season’s start have strengthened to a steady trade wind as

Australian spring racing declines in both crowd numbers and betting turnover.

Bad publicity driven by animal activists

through the Australian ABC slaughterhouse program and the double-edged sword

recoil from the Point of Consumption (POC) levies are the two likely causes. That

double-whammy has both damaged racing’s image and reduced betting turnover.

Nearly all of Melbourne’s major spring race days have been down in crowd numbers and turnover. Yesterday’s Oaks Day Flemington was the lowest for 25 years following attendance declines on both Derby and Cup Day. Inclement weather didn’t help, but anecdotally the pundits are saying public resistance towards racing is building due to the perception that racing has been negligent on its handling of the animal welfare issue.

In New Zealand the latest release of TAB figures is also disheartening. Most thoroughbred meetings in the past fortnight show declines comparative to the same meetings in 2018. Trentham, for example, on October 26th was 42.8 percent down, which translated to $835,462 less turnover. Ellerslie on Melbourne Cup Day was 5.5 percent or $158,006 down in turnover on the previous year.

A closer look at the figures shows increases in Fixed Odds Betting (FOB) but substantial declines in the tote. Recent TAB promotions offering up a free $50 bet (Spring Loaded) on the same day if your FOB selection didn’t either win or finish last is a contributing factor to the continued decline of the tote. The problem with that promotion is that the FOB profit margin is reduced in favour of turnover but the tote from which the racing codes get their best margin (14% to 15%) is cannibalised.

Nevertheless, overall turnover is down which

highlights two more concerning issues. Firstly, it tells us that all the

predictions of the FOB being the golden bullet were false and $50 million may

as well have been flushed down the toilet, but we already knew that. Secondly,

the FOB to maintain the status quo in its financial return to racing had to

earn an extra $17 million in profit annually just to pay the fees committed in

the contract to Paddy Power and Openbet.

Building the FOB Platform and expecting it to

work for New Zealand racing was a bit like backing a maiden handicapper to beat

Winx in a Cox Plate. But that’s what happens when you put a non-racing bureaucrat

in charge of the TAB – the third one in succession.

The

POC issue in Australia is justifiably sited as a cause for the decline in

betting turnover. The reason is simply that when betting operators are required

to pay this levy they amend the profit margin of their book upwards to cover

the levy and maintain their margin. The skinnier prices offered results in less

return to the punters which reduces the available funds for reinvestment – the net

result is reduced turnover or churn.

Corporate

bookmakers in Australia are unhappy about the POC levy because they claim they

already pay it when charged GST by the government. Point of Consumption refers

to the location of the customer and was introduced by the state governments of

Australia.

The

POC levy was first introduced in the UK when most betting operators were

located off-shore and were not contributing to the racing-sporting bodies or

government in the UK, and is the reason why the Australian corporates claim the

levy as a domestic one is unfair.

In

Australia, Betfair claim that they pay 51 percent of their wagering revenue in

other taxes and fees but when the POC levy is added at the South Australian POC

rate of 15 percent, their taxes rise to 66 percent. South Australia’s levy of

15 percent is the highest in Australia with both NSW and Victoria having set it

at 10 percent. Whatever the bookmakers say, they will receive no sympathy from

the punting public who are out to beat them any way they can.

The

world of betting has been undergoing substantial changes in 2019 and more is on

the horizon for 2020. Moves are afoot for a number of corporates plus Flutter

Entertainment – the group that controls Paddy Power Betfair and Sportsbet

Australia – to merge with The Stars Group which is TSG, the owner of BetEasy.

TSG is a global leader in revenue management solutions.

The

object is to create the largest online wagering and gaming company globally,

based in Dublin, listed on the stock exchange and worth 10 billion pounds. The

move comes as a result of the recent trend for betting operator mergers and

especially after the liberalisation of sports betting in the USA.

Spokespeople

for the potential merger which requires shareholder and government approvals

before it can proceed are saying that with the benefits of scale the fixed

costs annual savings will be in the vicinity of 140 million pounds.

Negotiations are expected to be finalised and the deal done by the middle of

2020.

Our

TAB and the FOB will have to compete with a scale of operator never before

seen. How do you think we will fare? Imagine the potential for this group’s

marketing, IT development and ability to offer punters a better deal than any

rival operator.

For an

overview of the New Zealand scene, I this week spoke to an Australian involved

in the betting world at a high level, and who was happy to project his view but

preferred not to be named.

He

said: “What I would say to New Zealand is that the local consumption market is

not enough to sustain the industry. New Zealand has brilliant rearing

conditions for growing horses and some excellent racing – you have a very good

product – it’s a solid product that can be improved. You need to think of

racing like your dairy industry and think of it as an export industry and

export it to the world – just like the NFL or the NBA.

“That’s

the future for New Zealand where the local turnover isn’t going to be enough.

Whatever you’re charging in fees, it’s

not going to be enough to sustain the industry over a long period. New Zealand

has a unique time-zone and you should exploit it.

“New

Zealand needs to do a whole lot of stuff – when you walk into an Australian TAB

outlet today, more often than not New Zealand racing goes to the second

channel. There’s no audio, so punters don’t know where their horse is in the

running. Every other country is doing microchipping, which shows where your

horse is in the running. For whatever reason in New Zealand this doesn’t

happen.

“New Zealand

racing takes too long in the barrier and too long to do raceday control. The

longer you take to do those things the more money you are holding back in

turnover.

“It also

needs to present its product better but you do have some advantages in your

time-line like 10 am betting for Australians. But what needs to be realised is that

in that time slot Australia is importing racing from places like Canada and

from the UK and various other places like Singapore and Hong Kong. And that

means that you guys need to up your game.

“Some

of the mid-week races in New Zealand are pretty innocuous but are holding

something like $50,000 or $60,000 a race. And that’s in pari-mutuel, so on top

of that you have the fixed odds and also the corporates. There is interest in

those races for what they are, but the crux is that even leaving aside the POC

levy, New Zealand doesn’t even charge a racefields fee.

“Tabcorp

has been losing ground every year to the corporates. From 89 percent in 2012 to

44 percent currently. That’s on total turnover. If New Zealand outsources there

are other options to Tabcorp. The corporates have devised some great promotions;

very innovative such as offering money back if your win bet runs second, third

or fourth or paying out if your horse loses on protest.

“There’s statutory law in Australian betting that

says the payout on the pari-mutuel win and place betting has to be 85 cents in

the dollar. But when betting on fixed odds, they are not restricted and bet

their own odds. And by our calculation, 40 to 50 percent of betting today is on

fixed odds.

“They are incentivising fixed odds betting so turnover is broadly coming down. Then you have sports betting, but the margin in a head-to-head situation is only about five percent. Turnover to racing is being lost to sports.

“On top of that you are losing turnover within

racing because the betting margins to bookmakers are getting larger. They are

doing that to compensate for racefields and POC tax, and at the same time, you

have got the TAB promoting the pari-mutuel into fixed odds, and then you have

the overall scenario where the corporate bookmakers are increasing their margin

share over the TAB.

“Bookmakers for years ran their books at about

114.5%. All that means is they were taking out 15 cents in the dollar. Now they

are averaging about 120 to 122 percent on FOB with the addition of racefields

and POC levies. Because the pari-mutuel has dropped so much the FOB is now

probably betting to a book of 120 to 125 percent.

“That means that at the start of betting, they’re

probably running at around 130 percent. Now that the fixed odds percentage is

so high, it means that less is paid out, due to racefields and POC, and

turnover decreases as a consequence.

“It’s inevitable that your FOB platform will be

obsolete in a very short time. From memory, even Sportsbet has outsourced their

underlying system – by that I mean

product development. When they introduce exotic results for the punter, which

has to be put into the system – that’s where they run into problems because

they are always developing new options including addressing the online mobile

site which is just growing so quickly.

“Gross Gambling Revenue (GGR) in Australia is

around $3 billion per year. GGR is what the punters lose. After everything,

there’s probably about half a billion dollars in profit. That just wagering.

“We supply the pricing and data platform technology,

etcetera to all the major corporates. We are also helping racing bodies export

their products globally, and that’s why I’m interested in New Zealand.”

The post Betting guru has advice for us Kiwis appeared first on .